Tax Exemptions and Abatements

Through an exemption, the City releases you from paying part or all of your property taxes. An abatement is a reduction in your taxes. We have information related to exemptions and abatements in the City of Boston.

Types of Exemptions

Through an exemption, the City releases you from paying part or all of your property taxes.

We have general information about filing for exemptions through the button link below, as well as details about specific programs in this section.

Learn more about how to apply for a 37A Blind exemption.

Learn more about how to apply for a co-op housing exemption.

Learn more about how to apply for a 41C elderly exemption.

Learn more about how to apply for a hardship exemption.

Learn more about how to apply for a National Guard exemption.

Learn more about how to apply for a residential exemption.

Statutory exemptions are for religious, charitable, benevolent, educational, literary, temperance, or scientific...

Learn more about how to apply for a 17D exemption.

Learn more about how to apply for a veteran exemption.

Fiscal Year 2026 Abatement Period

Property owners can file an abatement application if they believe their property is:

- overvalued

- disproportionately assessed

- improperly classified, or

- eligible for a statutory exemption.

Applications may be filed after the third-quarter bills are issued in late December 2025. The Fiscal Year 2026 abatement application filing deadline is February 2, 2026.

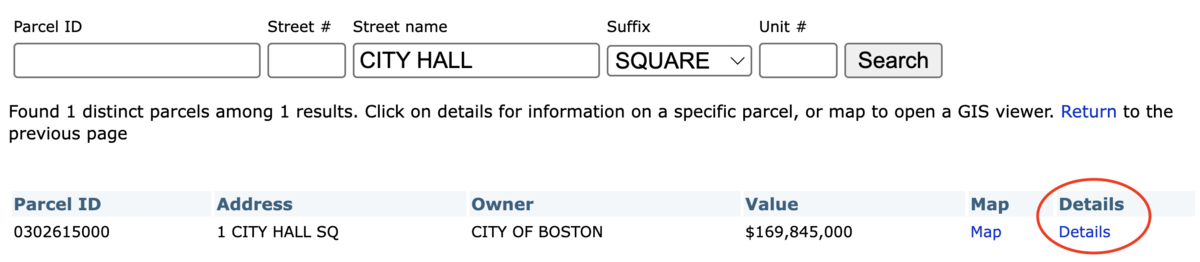

Abatement applications will be available online through the Assessing Online tool starting January 1, 2026. To download an application, search for and find your property, then click the "Details" link:

A link to the application will be under the "Abatements/Exemptions" section.

For more information on what's possible with Assessing Online, visit our explainer page. We also have details on how to get an abatement application either in-person or by mail.

Abatement information

Abatement informationYou can only file an abatement application for boat or motor vehicle excise taxes for specific reasons.

To file a personal property abatement application, you need to meet certain requirements.

You can file an abatement application if you meet certain requirements. You have the option to file the application by mail...